Unpacking the financial sector’s climate-related investment commitments

Report in collaboration with NewClimate Institute

The finance sector is key in taking steps to safeguard the objectives of the Paris Agreement. This report finds that financial institutions with cumulative assets of at least USD 47 trillion under management are currently committed to climate-related investment targets, which is around 25% of the global financial market. However, data on climate-related investment targets is scarce and does not allow for a straightforward quantification of impact on real economy emissions as financial institutions do not have full control over their investees’ emissions. Financial institutions can influence global greenhouse gas emission through three main mechanisms: divestment, positive impact investment, and corporate engagement. These factors play out differently per asset class and per target type, and insights into the factors or impact conditions may support financial institutions in setting potentially more effective targets. The report recommends that financial institutions transparently disclose their climate-related investment targets and underlying financed emissions data, which could be supported by leading global data.

Mark Roelfsema (Copernicus Institute, Utrecht University) collaborated with the NewClimate Institute in a first analysis of financial sector climate-related investment pledges. The study takes stock of existing pledges from financial institutions and discusses the mechanisms through which financial institutions can make impact on greenhouse gas emissions.

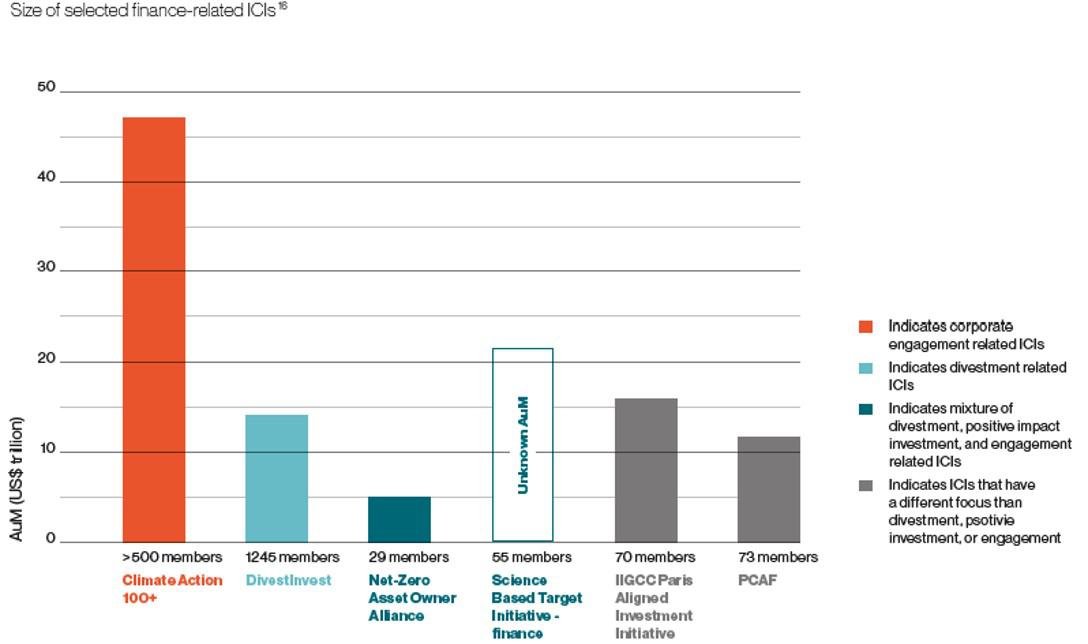

Financial institution’s climate-related investment targets have grown rapidly in recent years. We find financial institutions with cumulative assets of at least USD 47 trillion under management are currently committed to climate-related investment targets (see Figure below), representing around 25% of the global financial market. Although individual targets vary in their ambition and do not cover all assets under management, the number and growth of such targets is significant and represents considerable momentum.

While the trend and efforts of the financial sector are promising, it should be noted that financial institutions do not have full control over their investees’ emissions. Reducing the carbon intensity of a portfolio by divesting, with the objective of aligning it with the Paris Agreement, does not necessarily lead to emission reductions in the real economy, as others can invest in the emission intensive assets that were sold. Only if a large share of the financial sector sets and works to actualise robust climate-related investment targets and effectively implements them, investees will react and reduce their emissions.

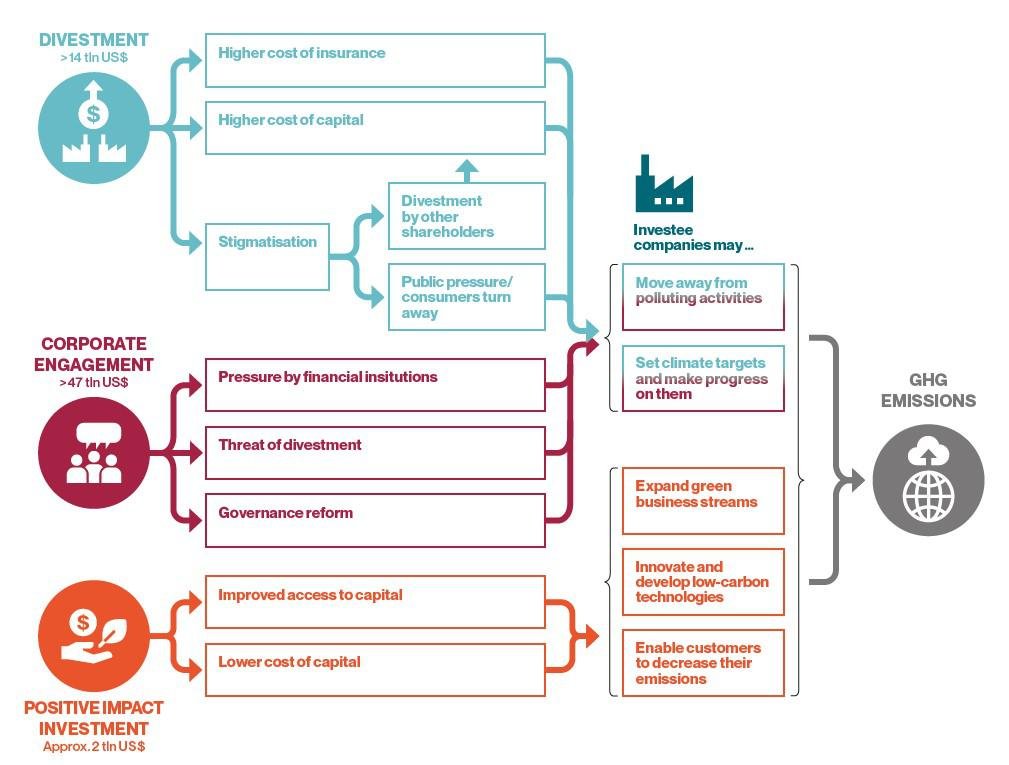

We identified three main climate-related investment mechanisms that financial institutions can use to influence global GHG emissions: divestment, positive impact investment, and corporate engagement (see figure below). In addition, several factors at the financial institution, company, and country level can increase the likelihood of climate-related investment targets to have an impact on actual emission levels. These include for example the size of a financial institution (measured by assets under management) and whether the targeted investee company has previous experience with ESG. The more these factors point in the right direction, the more likely that investment targets will lead to emissions reductions. The factors play out differently per asset class and per target type. Insights into the factors or impact conditions may support financial institutions in setting potentially more effective targets, policymakers to consider effective regulation and the scientific community, as well as the wider public, to better assess financial sector targets.

We recommend that financial institutions transparently disclose their climate-related investment targets and underlying financed emissions data. Further, leading global data platforms would need to better track and report those commitments. Finance-related international cooperative initiatives would also need to track their members’ targets and progress towards them. Similarly, to enable more financial institutions setting ambitious climate-related investment targets, we recommend both the finance and scientific community to further advance methodologies and understanding about what specific sector Paris-aligned pathways mean for investment decisions and different asset classes.